Fintech App Development Cost in 2025 & Factors Affecting It

FinTech app development costs depend upon several factors. Fintech apps with simple UIs and basic functionalities typically cost between $30k-$90k. Apps with more advanced features can cost upwards of $300k.

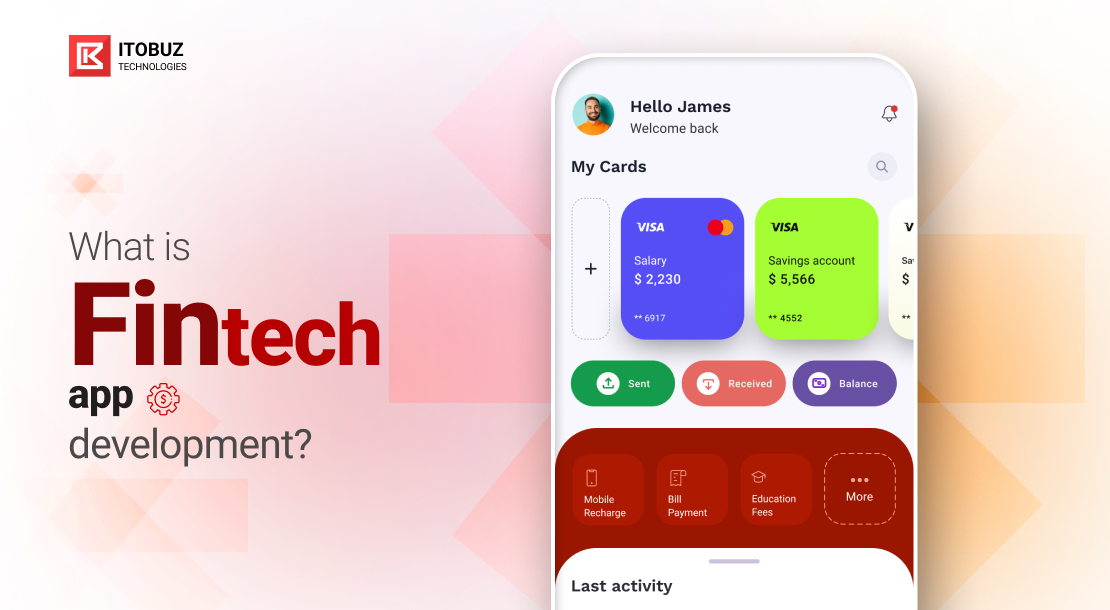

Introduction to Fintech App Development

Money makes the world go around – and financial services regulate how fast it rotates. ‘FinTech’ or financial technology is now making this world rotate faster than ever.

The expansion of the fintech industry has resulted from the proliferation of smartphones and mobile apps. Today’s customers are keen to enjoy a mobile life and naturally, they want to access their accounts, carry out transactions, and manage their funds irrespective of their location and their time.

FinTech apps are increasingly playing a significant role in ‘digitizing’ financial services and making them an integral part of users’ daily lives.

This has boosted client convenience and flexibility while also reducing the necessity for physical branches. Millennials and Gen Z’ers want to manage their money via these apps, instead of physically walking to branches to perform financial transactions.

Hence, fintech apps that support online banking, facilitate digital payments, and offer convenient investment management and budgeting tools, are high in demand.

- The global fintech market was worth over $200 billion in 2024

- Many fintech startups were launched last year

- There are now over 350 fintech ‘unicorns’ in the world

- India alone is home to 26 fintech unicorns

All of these billion-dollar companies are heavily invested in fintech app development.

What is Fintech App Development?

FinTech app development involves the creation of financial applications for mobile devices. To deliver the desired results Fintech app developers follow the best practices of mobile app development. They make use of advanced technologies to provide state-of-the-art financial services via agile, scalable, and customer-centric apps.

Fintech apps are set to play a critical role in the future of mobile app development.

If you can develop an innovative fintech app, you too can flourish in this industry and be a part of this blossoming future!

But how much will this endeavor cost you? More importantly, will it be worth the investment?

In this article, we’ll explain FinTech app development costs in detail. We’ll cover:

- The Factors Influencing the Cost of Developing a FinTech App

- The Different Types of FinTech Apps You Can Build

- The Core Features and Functionalities of FinTech Apps

- The Technology Stack Needed to Develop FinTech Apps

- The Importance of UI/UX Design in FinTech Apps and Its Cost

- A Breakdown of the FinTech App Development Process and Its Costs

Ready to finesse your way into the world of fintech apps? Let’s get started!

The Factors Influencing the Cost of Developing a Fintech App

The cost of developing FinTech apps is influenced by various factors:

Complexity of Features

The complexity and number of features you want in your FinTech app directly impact development costs.

Basic Features

Core functionalities such as user authentication and basic payment processing typically require 100-150 development hours. Such an app costs around $30k to $60k.

Apps like Venmo offer straightforward payment functionalities that fall into this category.

Moderate Complexity

Features like real-time analytics or AI-driven insights call for 200-400 additional hours, which translates to an estimated total cost of $60k to $90k.

For example, Mint is a moderately complex FinTech app that offers budgeting insights and expense tracking to users.

Advanced Features

Highly complex functionalities such as multi-currency support or automated trading algorithms can require 400+ hours of coding. For such apps, costs exceed $150k.

For example, Robinhood uses advanced algorithms for trading and market analysis.

App Type and Scope of Work

The kind of FinTech app you wish to create determines the overall costs.

Here is a breakdown of estimated development costs by app type:

| App Type | Development Time (Approx.) | Average Cost Range |

| Banking App | 2k – 3.5k hours | $120k – $300k |

| Lending App | 1.5k – 2.5k hours | $90k – $200k |

| Stock Trading App | 1.8k – 2.8k hours | $60k – $300k |

| Investment App | 3.5k hours | $90k – $200k |

| Personal Finance App | 1.5k – 2.5k hours | $60k – $300k |

Development Team Structure and Location

The composition and geographical location of your development team are critical in determining your overall costs. A typical FinTech development team includes:

- Business Analysts

- Financial Regulations Consultants

- UI/UX Designers

- Frontend/Backend Developers

- QA Engineers

- Project Managers

Salaries for these pros vary based on their location, experience level, and market demand. Hourly rates for fintech app developers also vary widely based on their national origin.

Since we are specifically discussing FinTech app development costs, here’s a chart you will find helpful:

| Country of Fintech App Developer | Avg. Hourly Rate ($) of Fintech App Developers |

| USA | $100 – $250 |

| UK | $30 – $60 |

| Germany | $50 – $90 |

| Poland | $30 – $50 |

| Romania | $25 – $50 |

| India | $15 – $50 |

| Australia | $40 – $80 |

| Vietnam | $20 – $60 |

Maintenance

Annual maintenance costs around 15-20% of the initial development cost.

Advanced Technologies Used

Integrating advanced technologies into your FinTech app can significantly impact development costs:

Digital Analytics

Incorporating digital analytics allows users to track their financial activities effectively. Basic analytics features may cost around $10k to $30k, while advanced analytics could increase costs to $50k or more.

Blockchain Technology

Blockchain integration is essential for secure transactions and transparency. Basic blockchain features may cost approximately $30k to $100k, and more complex implementations could exceed $150k.

Artificial Intelligence (AI)

It costs approximately $20k-$30k to implement basic AI features. Advanced AI systems may require investments of $100k or more.

Tools and Programming Languages Used

The app platforms and app development frameworks you work with play a huge role in your overall development costs:

Native FinTech Apps

These are built specifically for one platform – iOS or Android. Costs for native fintech apps are high because they require distinct development processes for each platform. Hiring specialized developers to work on the respective platforms is essential, and it increases your labor costs.

- Creating a native fintech app for only iOS costs between $60k and $180k.

- The cost of building a fintech app for only Android is $50k to $150k.

- If you hire separate teams to build individual versions for each platform, your overall cost increases by approximately 30% to 50%—we are talking somewhere between $100k and $300k.

Cross-Platform FinTech Apps

When cross-platform frameworks such as Flutter or React Native are utilized to develop FinTech apps, the pricing is less than that of native apps. The simple reason is that cross-platform apps do not demand separate codebases. Almost half of your finances are saved when you have a single team working on a single codebase.

- React Native app development cost typically ranges from $40k to $200k.

- Flutter fintech apps typically cost between $40k to $180k.

Infrastructure and Third-Party Integrations

Acquiring the right cloud hosting services (like Revolut uses AWS, PayPal uses Azure), setting up database management systems (Robinhood uses MongoDB), and making other arrangements for your fintech app’s technical infrastructure significantly impact your budget. Cloud hosting costs can range from $1k to $10k per month.

The Different Types of FinTech Apps You Can Build

Before moving into the details of how much different Fintech app features cost, let us take a look at the different types of Fintech apps that can be built, along with the cost involved.

Insurance Apps

Insurance applications streamline processes such as claims management, policy administration, and fraud detection. Key features of these types of fintech apps include:

- Payment processing

- Quote generation

- Claim filing

- Policy search

Building an insurance app can range from $45k to $200k. Your budget ventures into six figures if your insurance app uses advanced features like AI to automate claims processing like Lemonade does.

Investment Apps

Investment applications provide users with tools to manage their investments in real time. Their features often include:

- Stock trading

- Mutual funds management

- Cryptocurrency trading

- Asset research tools

- Commission-free trading

- Real-time market data

- Social trading

Developing an investment app usually costs $60k to $180k. You may have to spend more than that once scale your app globally like Robinhood.

Banking & Money Management Apps

Banking and money management apps are all about putting financial control right in the hands of users. They simplify everyday banking tasks with features like:

- On-the-go bank account management

- Instant fund transfers

- Bill payments

- Simplified loan application processes

You have to spend somewhere between $30k and $300k for developing a banking app.

RegTech Apps

Regulatory Technology (RegTech) apps are the support system for businesses navigating the intricate world of compliance and regulation. They offer:

- Compliance monitoring

- Risk management

- KYC (Know Your Customer) processes

- Reporting automation

Building a RegTech app typically costs between $50k to $150k. If you are looking to incorporate advanced features like machine learning for real-time compliance checks, your budget might stretch further, similar to what companies like 6 Clicks invest.

Money Lending Apps

Money lending apps simplify how people access loans by connecting borrowers directly with lenders. Essential features include:

- Loan application processing

- Credit scoring

- Payment tracking

- User-friendly dashboards

Developing a money lending app like Earnin costs you $50k to $180k.

Consumer Finance Apps

Consumer finance apps are all about helping users take charge of their personal finances with features like:

- Expense tracking

- Budgeting tools

- Financial goal setting

- Personalized financial advice

Creating a scalable consumer finance app like Mint can cost anywhere from $50k to $300k.

Accounting Apps

Accounting apps simplify financial management for individuals and businesses. These apps feature:

- Invoicing

- Expense tracking

- Tax Preparation

- Financial Reporting

The cost to develop an accounting app typically ranges from $50k to $200k.

| Type of App | Est. Development Cost |

| Insurance Apps | $45k – $200k |

| Investment Apps | $60k – $120k |

| Banking Apps | $30k – $300k |

| RegTech Apps | $50k – $150k |

| Money Lending Apps | $50k – $180k |

| Consumer Finance Apps | $50k – $300k |

| Accounting Apps | $50k – $200k |

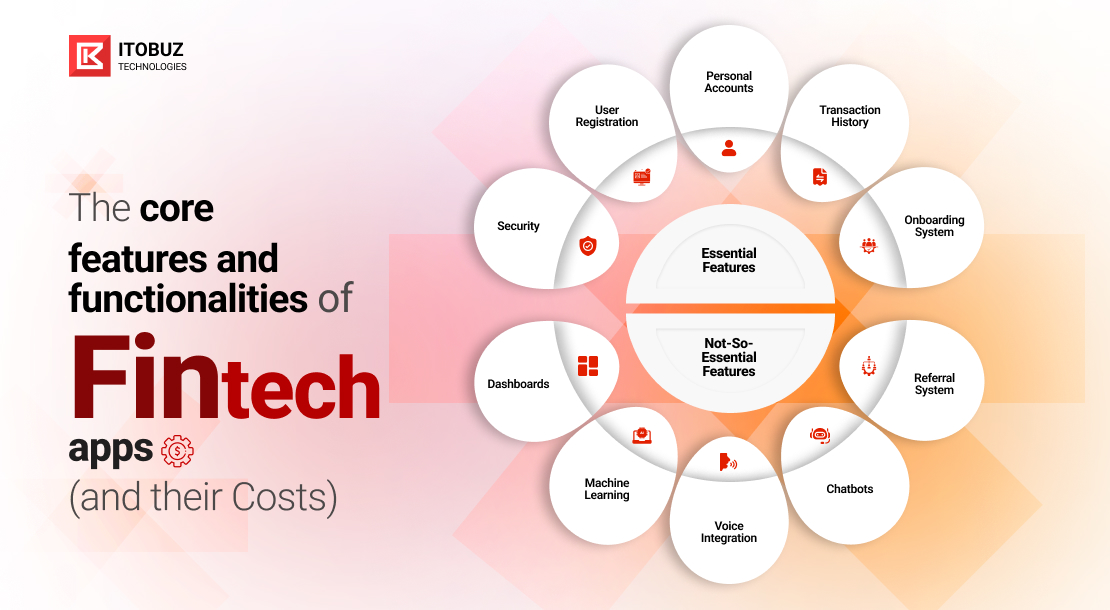

The Core Features and Functionalities of FinTech Apps (and their Costs)

Now, let us go through the essential and not-so-essential features of a fintech app and how they impact your development costs.

Essential Features

These features are fundamental to any fintech app.

Security

For ALL fintech apps, the following security measures are non-negotiable:

- Encryption to secure data in transit and at rest

- Biometrics for app access

- Two-factor authentication (2FA) for logins

Implementing these security features costs you between $10k to $100k.

User Registration

A streamlined user registration process enhances UX while ensuring compliance with regulations. It should include multiple authentication options for added security. Developing a user-friendly registration feature can cost around $5k to $15k.

Personal Accounts

This feature enables users to manage their finances, track transactions, and access financial services seamlessly. Implementing personal account functionalities costs between $10k to $30k.

Real-Time Notifications

Keeping users informed about transactions and account activities is essential for building engagement and trust. Instant notifications help users monitor their financial activities closely. Setting up notification systems can cost from $5k to $20k.

Transaction History

Providing users with access to their transaction history promotes transparency. Developing this feature typically costs around $5k to $15k.

Onboarding System

Costs for developing and designing a stellar onboarding system for new users generally range from $10k to $25k.

Not-So-Essential Features

While these features add value to most fintech apps, they are not strictly necessary for supporting their core functionalities.

Dashboards

Developing an intuitive dashboard that gives users visual insights into their financial data can cost between $15k to $60k.

Machine Learning

Using machine learning algorithms enables your app to generate personalized insights based on user behavior. Integrating ML capabilities can range from $20k to $150k.

Voice Integration

Implementing voice technology that lets users interact with the app through voice commands typically costs between $10k and $30k.

Chatbots

Integrating chatbots as customer support tools cost between $10k and $25k.

Referral System

Implementing a referral system that encourages users to invite others to the app can cost between $2k to $7.5k.

Card Scanning Features

These features simplify adding payment cards to user accounts through scanning technology. Their cost ranges from $10k to $25k.

Cashback Program

This feature rewards transactions made via the app. It encourages users to engage with the app more frequently. But, it is not critical for functionality so it is not that expensive (maximum $5k) to develop.

KYC (Know-Your-Customer) Features

Collects user information for compliance while enabling personalized services. It is essential in regulated markets but may vary based on app type. The cost ranges from $10k to $30k.

The Technology Stack Needed to Develop FinTech Apps

Now, let us see how your choice of technology affects your overall expenses:

Programming Languages

- Android Apps: Java or Kotlin.

- iOS Apps: Swift or Objective-C.

Choosing the right programming language can affect development costs by approximately $5k to $15k.

Integrated Development Environment (IDE)

- Android: Android Studio.

- iOS: Xcode.

While IDEs incur minimal direct costs, their efficiency can influence overall project timelines.

Databases

Common databases for both platforms include:

- MySQL

- PostgreSQL

- MongoDB

- Cassandra

Database setup and integration can range from $10k to $30k, depending on data complexity.

Cloud Platforms

Key cloud services for hosting and scalability:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

Using cloud platforms typically costs between $1k to $10k per month, based on usage.

Payment Gateways

Essential for transaction processing:

- PayPal

- Stripe

- Braintree

Payment gateway integration generally ranges from $10k to $50k.

UI/UX of FinTech Apps

UI/UX design is a critical component in FinTech app development.

User-Centered Design

FinTech apps cater to diverse user groups, each with unique needs. A user-centered design approach involves

- Segmenting users based on their financial activities.

- Creating user journeys that resonate with each segment.

Customizing the UI/UX for different user segments can increase costs by $15k to $40k.

Compliance with Regulations

FinTech platforms must adhere to regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML). This compliance creates specific UX challenges:

- Streamlining onboarding processes while ensuring thorough identity verification.

- Communicating the importance of compliance measures clearly to users.

Designing compliant user experiences may add $10k to $25k to development costs due to additional features and communication strategies required.

Adhering to Users’ Expectations

Designing interfaces that align with users’ expectations reduces cognitive friction and enhances usability. This includes

- Consistent visual hierarchies that guide users’ attention.

- Using familiar concepts to build trust and confidence.

Investing in research and testing to align designs with user mental models can add $10k to your budget.

Gamification and Social Elements

Incorporating gamification can enhance user engagement by making financial tasks more enjoyable. We are talking

- Achievement badges for reaching financial goals

- Collaborative tools for sharing progress with peers

Adding gamification elements can increase development costs by $5k to $20k.

Development Process and Its Costs

Developing a FinTech app involves several critical stages, each with its own set of costs:

Pre-Development Phase

This phase focuses on research, planning, and prototyping to define the app’s purpose and target audience. Key activities include:

- Understanding user needs and market trends.

- Outlining project scope, features, and timelines.

- Creating wireframes or mockups to visualize the app.

This phase typically costs between $10k and $30k, depending on the depth of research and complexity of the prototype.

Development Phase

This is where the actual coding happens. It includes:

- Building the user interface.

- Setting up servers, databases, and application logic.

- Connecting payment gateways, APIs, and other services.

The development phase can range from $50k to $300k, influenced by the app’s complexity.

Post-Launch Maintenance

After launching the app, ongoing maintenance is crucial for performance and user satisfaction. This includes:

- Addressing bugs that arise after the launch

- Adding new features based on user feedback

- Analyzing usage data to improve functionality

Maintenance typically costs around 15% to 20% of the development budget per year.

Step-by-Step Guide to Creating a FinTech App

Select a FinTech Niche

Identify your target market (e.g., personal finance, investment) and analyze user needs. This decision impacts feature selection and compliance requirements.

Compliance Alignment

Ensure adherence to regulations like KYC and AML from the beginning. Compliance considerations can add approximately $10k to $25k in design costs due to necessary features for identity verification.

Feature Consideration

Decide on essential features based on your niche. Basic features may include secure login methods, budget tracking, and transaction capabilities. The cost for integrating these features can range from $30k to $100k, depending on complexity.

Build a Development Team

Assemble a team with expertise in FinTech mobile app development or team up with a reliable mobile app development agency.

App Design

create an intuitive UI/UX that enhances user engagement.

Develop an MVP (Minimum Viable Product)

Create an MVP to validate your concept with minimal features. This approach helps save costs and allows for early user feedback. Developing an MVP may range from $30k to $80k, depending on selected features.

Quality Assurance

Conduct thorough testing to ensure functionality and security before launch. Quality assurance processes can add around $10k to $25k to your budget.

Deployment

Launch your app on chosen platforms (iOS, Android, or both). Deployment strategies may incur additional costs based on platform-specific requirements.

Ongoing Support

Provide continuous support for users post-launch to address queries or issues promptly. Support services can cost approximately $5k to $15k annually, depending on the level of service provided.

Conclusion

The FinTech sector has seen a significant influx of investment since 2020, with startups eager to disrupt traditional banking systems. Several factors contribute to the current growth of FinTech.

One major driver is the promise of attractive returns on investments and opportunities for expansion, despite some business models still being in development.

Emerging technologies also play a crucial role in the evolution of financial services. Innovations such as blockchain, advanced machine learning algorithms, compact payment devices, and powerful analytics servers are reshaping the industry.

Social media and targeted marketing strategies have also lowered customer acquisition costs significantly, sometimes to as little as 1% of traditional banking costs.

Customer expectations are another driving force in FinTech’s rise. Unlike previous generations that experienced impersonal banking relationships, millennials and Gen Z demand more personalized interactions.Do you want to enter this exciting and lucrative sector by developing your own, world-class fintech app? Look no further than Itobuz! Our fintech app development company offers free consultations and detailed quotes. Contact us now to learn how we can meet your specific needs and at what cost.

comments

comments for this post are closed