Banking App Development Cost Breakdown – Is It Costly?

The cost of developing a banking app in 2025 can range from $35k to $350k.

The more features, UI/UX design elements, and other complexities your banking app has – the farther your budget will end up in this cost range.

Complex banking apps with highly advanced features like multiple API integrations or AI tools can cost upwards of $1 million.

Why are we talking about banking app development costs?

Well, the rapid advancement of digital technologies has brought about a paradigm shift in the financial industry. User-centric mobile apps and API-based ecosystems have become the new normal as digitization in the industry has reached new levels.

Many high-performing banking organizations have already embraced this disruption and reimagined their customer service channels with custom mobile apps.

Thankfully, there’s still plenty of room for both established players and innovative startups to enter this $2.2 billion-dollar market that’s rapidly expanding at a CAGR of 20%.

However, unlike major banks like Bank of America or Capital One Bank, not all of these businesses have endless resources to pour into their app development efforts.

If these firms want to kickstart a realistic and profitable banking app development project – they must learn every possible detail about mobile banking app costs.

Let us begin our digital banking journey!

Why Do Businesses Need a Banking App?

Why should financial institutions invest in digital mobile banking solutions? Because banking customers want it. According to a recent survey by Forrester, 73% of adults in Australia, 68% in the UK, and 65% in the US want to accomplish all financial tasks through mobile apps. For these adults in key markets, mobile banking apps are essential tools for managing their finances on the go.

Ignoring these demands means potentially losing customers to competitors who prioritize digital convenience. It also means not being able to:

Offer Enhanced Customer Experiences

Mobile apps can offer 24/7 access to services like payments, transfers, and credit monitoring. Features like AI chatbots simplify tasks, while personalized insights help users track spending or save for goals. For example, apps with “humanlike” interfaces and conversational AI bots that answer questions naturally can reduce user frustration and cultivate more loyal user bases.

Organizations that do not have such feature-heavy custom apps will not be able to deliver industry-standard experiences in 2025.

Streamline Operations, Reduce Costs

Custom mobile apps can automate routine tasks (e.g., balance checks, and fraud alerts), cut manual workloads, and eliminate all types of data entry errors. With these digital tools, financial organizations can save money by reducing branch visits and call center demands.

Advanced analytics can also help these organizations use data to understand what customers need and in the long run – predict customer needs. As banking becomes more automated in 2025, organizations without their own apps will get left behind.

Secure Competitive Advantage

The global banking market is responding to the modern users’ needs we listed above. The number of digital banking users is projected to steadily grow at a rate of 6.86% until 2029. Leading banks already use AI, real-time data, and open APIs to create “connected” experiences – like letting users manage accounts across apps or partner platforms. Innovations like embedded finance (e.g., banking within shopping apps) or predictive, AI-powered financial advice are now being used to set banking brands apart.

Institutions that fail to realize the critical importance of banking apps and do not invest in robust apps, risk falling way behind.

Future-Proof the Business

Mobile apps make modern customers feel in control. They boost satisfaction and retention. Banks investing now in “empowering” mobile app features such as personalized alerts or automated savings, will stay ahead.

Organizations that fail to recognize these obvious benefits of banking apps will soon become obsolete.

Key Features of a Mobile Banking App

To provide a seamless and secure banking experience, mobile banking apps should include a range of essential features.

Must-Have Features

These are the foundational elements that every banking app should have to meet basic customer needs.

Account Management

This feature allows users to view real-time balances, track transaction history, access statements, link savings accounts, and set financial goals. It eliminates the need to visit branches or call customer support for basic information.

Secure Transactions

Ensuring the security of all financial transactions inside your app is paramount. This involves protecting every payment, transfer, or deposit with end-to-end encryption and using secure APIs and tokenization.

Push Notifications

Real-time alerts for logins, payments, or suspicious activity keep users informed. These notifications help them detect fraud or unauthorized access.

Multi-Factor Authentication (MFA)

Want your banking app to be ultra-secure? Add multiple layers of security. Add biometric scans (fingerprint, face ID) or one-time passwords (OTPs) for logins. These layers will prevent all unauthorized access to your app.

Advanced Features

These functionalities enhance the user experience and provide added value. They can help you differentiate your banking app from its competitors.

AI-Driven Personal Finance Management

AI tools can analyze spending patterns, categorize expenses, and offer instant budgeting tools. These features can help banking app users make informed financial decisions. They can help users achieve their savings goals.

Investment Tracking

This feature allows users to monitor their stocks, mutual funds, or crypto portfolios in one place. It helps users research stocks and make appropriate trades. It also gives users real-time market updates and performance insights.

Chatbots for Customer Support

AI-powered chatbots can resolve customer queries instantly. From unlocking cards to explaining fees – these bots can reduce wait times and improve customer satisfaction.

US Bank uses AI-powered chatbots in its mobile app to provide instant customer support and answer common banking questions.

A ‘great’ banking app is a secure, intuitive tool that always adapts to the latest financial needs. Banks that neglect to add these features to their apps risk losing customers to competitors that do.

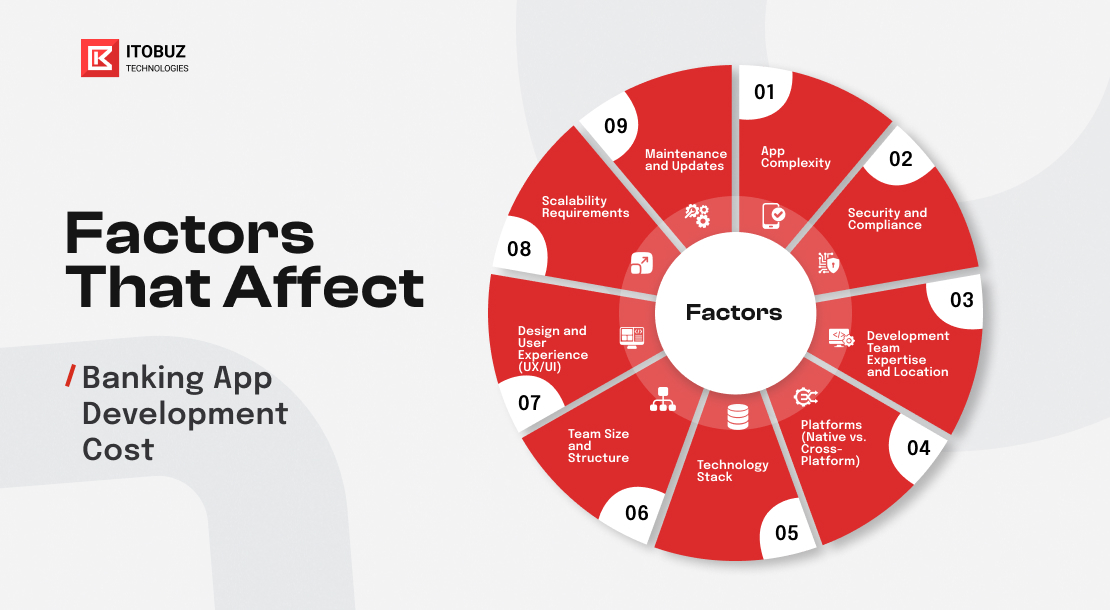

Factors That Affect Mobile Banking App Development Costs

Now that you know what features make a ‘great’ banking app, let us go through all the key factors influencing app costs. Here’s an in-depth banking app cost breakdown:

App Complexity

The complexity of the app is a primary driver of development costs.

Apps with only core functionalities like account registration, balance checking, transaction history, and fund transfers are relatively straightforward and less expensive to implement.

Adding advanced features like AI-powered financial advice, real-time spending analytics or in-app customer support can significantly increase the app’s complexity and cost.

Creating essential banking features (account creation, balance inquiry, transaction history, fund transfers) involves standard programming techniques. All of these features also have well-established security protocols.

On the other hand, adding a custom support chat feature can take approximately 170 extra hours of development, while creating an AI admin panel could take 300+ hours.

The addition of each advanced feature not only extends the development timeline but also increases the need for more specialized skills and advanced security measures.

Security and Compliance

Rigorous security measures and adherence to complex regulatory requirements are non-negotiables for banking apps. So, these factors are substantial cost drivers.

Maintaining compliance with GDPR, CCPA, PCI DSS, and similar data privacy laws means you’ll have to mandate secure data handling practices, robust encryption, and user consent mechanisms throughout the project.

The setup + ongoing maintenance of these systems, combined with the need for specialized legal/security expertise will substantially inflate your development and operational costs.

Development Team Expertise and Location

A team with proven expertise in fintech, mobile security, UI/UX design, and regulatory compliance is crucial for building a reliable and secure banking app. The skills and geographic location of this banking app development team will significantly impact your expenses.

Okay, here’s the information about development team location costs presented in a chart format:

Okay, let us break down these crucial cost factors in building a banking app, with straightforward explanations and up-to-date cost insights for easy understanding.

Platforms (Native vs. Cross-Platform)

Your choice here carries major cost and performance implications:

Native Development (iOS and Android)

Think of native apps as custom-built apps for iOS and Android platforms. Native apps run super smoothly on their native platforms/devices and can use all the cool built-in device features like fingerprint scanners or facial recognition.

However, because you are building two separate apps – one for iOS and one for Android – your costs essentially double.

The cost of developing an iOS app ranges from $30k-$300k. Android apps cost $25k-$250k.

Cross-Platform Development (React Native or Flutter)

Imagine building once and deploying on both iPhone and Android. Cross-platform frameworks (React Native or Flutter) let you do that and save both time + money. Let’s see how much react native app’s development cost in details.

You are looking at a total cost of roughly $100k-$200k. The trade-off? These apps might not be quite as fast or polished as native ones and specialized features can be harder to implement.

Learn more about mobile app development frameworks before you make this call.

Technology Stack

The tools you select for developing the app impact costs.

Programming Languages and Frameworks

Using newer, more efficient languages like Kotlin (for Android) and Swift (for iOS) might add about 15% to your initial development costs. But, this can reduce bugs and maintenance efforts by 30% in the long run. Using newer frameworks, such as Spring Boot for the backend, can speed up development by around 20% and increase security.

Database and Cloud Services

A reliable database like PostgreSQL will cost you roughly $10k – $50k annually. Cloud services like AWS or GCP start around $10k/month. These investments may seem like high upfront costs. But, these database + cloud services will enhance your app’s scalability, security, and long-term cost-efficiency.

API Integrations

APIs (application programming interfaces) allow your app to connect to different services. Here are some essential banking app integrations that you won’t be able to avoid in 2025. Payment gateways (like Stripe or PayPal) cost about 2.9% + $0.30 per transaction and $15k – $50k for initial setup.

- Integrations with credit bureaus (like Experian or TransUnion) cost around $0.50 – $2 per API call.

- Identity verification services (like Onfido or Jumio) costs about $1-$5 per check.

- Integrations with core banking systems could cost you about $50k – $100k.

Design and User Experience (UX/UI)

A good design and easy-to-use interface greatly influence your app’s cost. But, it might also determine your app’s success. The more of these steps your User Experience (UX) and User Interface (UI) designers undertake, the higher your overall costs.

- User research (around $10k-$20k)

- Creating wireframes and prototypes (approximately $15k-$30k) for testing out app design ideas

- Conducting usability testing ($5k – $10k per test)

Scalability Requirements

To ensure an app runs reliably and efficiently, it must have a design that can handle increasing numbers of users.

Setting up cloud auto-scaling (using AWS) costs approximately $20k – $50k. Load testing (using tools like LoadRunner) costs around $5k – $15k.

Maintenance and Updates

After the banking app is launched, it’ll require patches, bug fixes, OS updates, and new feature updates. These ongoing maintenance and update costs are approximately 15-25% of the initial development cost.

Team Size and Structure

A banking app development team includes

- Project managers

- Backend engineers

- Mobile app developers

- UI/UX designers

- QA testers

- Security experts

- Compliance officers

A US-based team featuring these pros might cost more than $500k annually. Offshoring to Eastern Europe or India could reduce costs to approximately $200k – $350k annually.

A hybrid approach can cut that $500k annual cost by about 30%.

How Much Does It Cost to Develop a Banking App?

To understand banking app pricing, think about two main things:

- How long it takes to build the app (time)

- How much developers charge per hour (hourly rates)

Your total cost will be a combination of these two. How long it takes to build a banking app depends on whether you choose native or cross-platform app development. Going native and building separate apps adds about 40% more time compared to building one cross-platform app.

If you want fancy features like AI-powered chatbots or cryptocurrency wallets – expect them to add 2-4 months of development work. Using the latest tools (Kotlin/Swift) can reduce bugs down the road but can add about 10-15% more time upfront as your developers learn these new tools. Each API you custom integrate (Stripe/Onfido) adds roughly 50 hours of work.

To put it all together, here’s a general breakdown of cost based on the features you want in your app:

Do not include these prices in your banking app cost estimation. The location of your development team will have a huge impact on overall costs. Here are the hourly fees of the most popular banking app developer talent pools.

- USA: $100 – $150/hour

- Eastern Europe: $40 – $80/hour

- India: $25 – $50/hour

Depending on which of these talent pools you hire from, you can expect the following costs.

Hiring banking app developers from the USA or Canada costs more because of the specialized compliance and security expertise those experts bring. Hiring from Eastern Europe balances cost and quality effectively. Also, India with its affordable banking app development costs has emerged as a major outsourcing location for banks and financial institutions.

To make the most of the mobile banking app development costs you incur,

- Start with a simple, cross-platform app to test the market and save around 40% compared to native.

- Do not add complex features like AI or crypto initially.

- Create a hybrid team by combining in-house compliance experts with offshore developers.

A medium-complexity app developed in India might cost the same as a basic one built in the USA. Prioritize the features you need and don’t pay for unnecessary extras!

Steps to Create a Banking App

Now that the costs are clear, let us go through the banking app development process. Here are the main mobile banking app development steps.

Ideation & Planning

Your first goal is to ensure that your app aligns with market needs and user expectations.

Market & Competitor Analysis

Before diving in, understand the playing field. Conduct market surveys to identify gaps in existing apps’ offerings. Analyze what competitors do well (e.g., Chime’s Personal Finance Management (PFM) tools) and where they fall short (e.g., the lack of QR code payments in older banking apps).

Target Audience Analysis

Consider who will use your app. Are they urban professionals or rural customers? What are their digital habits? Understand their unique needs. If you are targeting areas with unreliable internet, prioritize offline functionality. Millennials might appreciate features like 24/7 account access and AI-powered budgeting.

Define Purpose & Goals

Pinpoint the core problem your app will solve. Establish clear goals (e.g., 50k downloads in the first 4 months with 50% retention).

Feature and Tech Stack Selection

Next, select the right technologies to bring your vision to life (without breaking the bank).

Core Features

Determine the must-have features for your app. Then consider advanced features such as AI-powered chatbots or cryptocurrency wallets. Note that advanced features can add 30-40% to development time.

APIs & Integrations

Application Programming Interfaces allow your app to connect to different services. Your app will need at least two types of essential API integrations.

Tech Stack

Select the right technologies for development. If prioritizing security (like JPMorgan Chase), opt for native development using Swift (for iOS) and Kotlin (for Android). If cost is a major concern, consider cross-platform frameworks like Flutter (Flutter app development cost is much lower). For backend development use Spring Boot (max scalability) and PostgreSQL (max data integrity).

Platform Strategy

Maximize your app’s reach while carefully managing development costs by choosing the right platform. If your target users are primarily high-income individuals (e.g., in major cities), prioritize iOS development. For broader global reach, focus on Android, which dominates emerging markets.

Cross-platform development offers a faster launch and is ideal for startups that need to get to market quickly. PWAs are budget-friendly for offering basic banking services – suitable for regional banks targeting small customer bases.

UI/UX Design

Next, design a user interface (UI) and user experience (UX) that builds trust through simplicity.

Wireframing + Prototyping

Carefully map out the user’s journey through the app. Design the bill payment process to take no more than 3 taps. After testing the wireframes, progress to interactive prototypes to test user flows. Test key steps like how users split bills or transfer money. Gather feedback to refine the prototypes’ designs.

Platform-Specific Design

Ensure your app is accessible to all users across all targeted platforms. Offer screen reader support, and high-contrast themes, and maintain adherence to accessibility guidelines like ADA/WCAG. For iOS, adhere to Apple’s Human Interface Guidelines (e.g., for Face ID integration). For Android, follow Material Design principles (e.g., customizable dashboards).

Development

As your app’s UI/UX design is getting finalized, ask your developers to start creating a secure and scalable app.

Frontend

- For Native apps, use device hardware for features like biometric authentication to maximize speed/security.

- For cross-platform apps, use pre-built widgets for faster UI rendering and a consistent look.

Backend

Security

Implement end-to-end encryption and AI-powered fraud detection. Conduct penetration tests and ensure compliance with OWASP guidelines. Budget around $15k-$30k for comprehensive security testing.

Testing

Thoroughly test the app again to identify and eliminate potential issues before launch. Conduct load testing to simulate high user traffic (e.g., 100k concurrent users) to prevent app crashes during peak times. Conduct beta trials with real users to identify and fix any remaining usability issues.

Deployment

Launch your app smoothly and efficiently across app stores. iOS has strict data privacy review processes (approval can take 2-4 weeks). Google Play is faster but requires PCI-DSS certification. Deploy the app in phases, starting with a limited geographic area (e.g., Australia) to gather initial feedback.

Maintenance & Growth

Plan for monthly operating system (OS) compatibility patches (budget $5k-$15k/year). You should aim for quarterly feature releases. Implement chatbots to handle common queries. Track KPIs (e.g., drop-off rates during bill payment) to identify areas for improvement, and keep refining the app’s user experience accordingly.

Challenges in Banking App Development

Before you kickstart development, learn about the many banking app development challenges most teams face. Here are some common issues in banking app development you need to be cognizant of:

Ensuring Security and Compliance

Your banking app will handle incredibly sensitive user data. It will be a target for cyberattacks. Failing to protect customer data = massive fines and irreparable reputational damage.

To secure your banking app:

- Implement multi-layered security.

- Hire cybersecurity experts to regularly test your app for vulnerabilities.

- Encrypt all sensitive data stored on servers.

- Train your developers on secure coding practices.

Remember – compliance or security are not one-time things. Regulations and app development practices change all the time. Stay informed about regulations and future trends in mobile app development. Adapt your development plans and security measures accordingly.

Managing Scalability

Will your banking app slow down or crash as it starts to attract more users or process more transactions? To ensure that this is not the case:

- Only use cloud platforms that allow you to easily increase server capacity as needed.

- Distribute user traffic across multiple servers to prevent any single server from becoming overloaded.

- Use efficient database queries to minimize database load.

- Use data caching techniques to improve response times.

- Break down your app into smaller, independent services that can be scaled individually.

- Use CDNs to store and deliver static content from servers located closest to your users.

Balancing Features with Usability

Too many features can overwhelm users and make the app difficult to use. So, initially focus on delivering the essential banking features flawlessly. Make sure it is easy for users to check their balance, transfer funds, pay bills, and manage their accounts. Prioritize user-centered design, keeping the user interface (UI) uncluttered, and easy to navigate. Gradually introduce new features and options as they become more comfortable with the app. Conduct regular usability testing with real users.

How to Choose the Right Banking App Development Partner

Do you find these laborious development processes and challenges intimidating? Do not worry. The secret to getting through these challenges is partnering up with an experienced banking app development company. Here’s a point-by-point rundown on choosing a development partner that is up to the task.

Look for Relevant Experience

You want a team that’s ‘been there, done that’ with banking apps. They understand the specific security and regulatory challenges involved. They will also have a library of code and components they can reuse to save you time and money.

Ask to see examples of other banking or finance apps they have developed. Look for detailed case studies that highlight their successes and the challenges they overcame. Contact past clients and ask about their experience working with the team.

Look for Technical Expertise

Building a banking app requires a specific skill set, including:

- Proficiency in Swift, Kotlin, React Native, Spring Boot, or any other technologies you have chosen for your app

- Certifications like Certified Information Systems Security Professional (CISSP) or Certified Ethical Hacker (CEH)

- Experience integrating with payment gateways, credit bureaus, and other third-party services

- Proficiency banking mobile development (iOS and Android)

- Experience in backend development

Look for Security Focus

You need a team that prioritizes security at every stage of the development process. Ask about their secure coding practices and how they prevent vulnerabilities. Ensure they adhere to the OWASP (Open Web Application Security Project) guidelines. You also need to verify whether they conduct regular penetration testing.

Look for Collaboration

Effective communication and collaboration are essential for a successful project. You need a team that is responsive, transparent, and offers:

- Clear communication channels

- Prompt response to your questions and concerns

- Project management tools to track progress and manage tasks

- Agile development methodology

Look for an Understanding of Regulatory Compliance

Your development team must understand:

- GDPR, PCI DSS, and other relevant regulations

- KYC (Know Your Customer) requirements

- AML (Anti-Money Laundering) requirements

Use this checklist the next time you’re evaluating potential development teams or agencies:

Future Trends in Banking Apps

Before you start seeking out banking app development services, learn about these trends to get an idea of what an exciting field you’re about to enter:

AI and Machine Learning for Predictive Analytics

Beyond tracking → Anticipating needs

Imagine your banking app not just showing you where you have spent money – but predicting where you will spend money and offering personalized advice to help you save more.

That’s the power of AI (Artificial Intelligence) and machine learning. These technologies analyze vast amounts of data to identify patterns and make predictions about user behavior.

They can now make your app auto-negotiate bills (e.g., lower APR on loans) and predict cash flow gaps before they hit.

Blockchain for Secure Transactions

Blockchain’s decentralized ledgers are killing fraud-prone processes:

- Slash fees from 7% (traditional) to 1% (blockchain)

- Auto-release mortgage funds when home inspections pass

Bonus meme – every transaction is traceable which makes your app’s transactions virtually impossible to alter.

Biometric Authentication

Your Face = Your Password. Bye, PINs. Hello, biometrics. Facial scans and voiceprints are becoming the norm with top banking apps now offering touchless logins.

Why is this trend so popular?

Because it is 3X faster than typing passwords and 2X better at fraud reduction.

The next frontier in this technology is behavioral biometrics, i.e., apps learn how you hold your phone to block imposters mid-swipe.

mobile banking app development cost

Your data, your control. APIs now let you fuse banking with third-party tools seamlessly. Link your app to QuickBooks for real-time biz cash flow updates. Or, link it to Robinhood to auto-invest spare change

90% of major banks here now share data via APIs. It allows apps to aggregate all finances of a user in one feed.

Conclusion

Getting banking app development right is not just about coding – it is about balancing cutting-edge features with cost-smart decisions.

Skimp on security or compliance? Risk paying large amounts in fines like this whole sector did ($3.2+ billion in fines) last year.

Over-engineer? Blow budgets on flashy tools most users ignore.

The sweet spot? A lean, secure, and custom banking app that solves real problems without bleeding cash or users’ attention.

Your Next Move? Partner, Don’t Gamble. Collaborate with a provider who offers:

- Zero-fluff consultations – get a roadmap tailored to your budget—no sales jargon

- Transparent quotes – know every dollar’s destination, from AWS cloud setups to AI integration

- Future-proofing – adopt trends like biometric logins or open banking APIs into your app from day one

That’s us! At Itobuz, we craft custom banking apps that marry innovation with ROI. Whether you are a startup eyeing cross-platform speed or an enterprise needing ironclad blockchain security, our banking app development services are built to scale. Get a quote for banking app development – for free today! Let our world-class mobile app development services turn your vision into a banking app that revolutionizes the world of finance!

comments

comments for this post are closed