AI-Driven Financial App Development Guide for 2025 Success

The financial app development industry is not just growing – it is mutating at a rapid pace. What started as clunky mobile banking is set to become a $1.5 trillion beast fueled by NFC payments, crypto chaos, and Gen Z’s insatiable appetite for financial independence. At the center of this multi-trillion-dollar titan are financial apps reshaping how we stash, spend, and grow our cash. These fintech apps have simplified financial management, democratized Wall Street by making commission-free trading more accessible and made crypto go from geeky to mainstream.

And guess what – fintech app development is showing no signs of slowing down.

In Q1 2024, finance app installs surged 36% YoY, sessions jumped 23%, and in-app revenue skyrocketed 119%. In Q1 2025, we expect to see similar figures.

Why? Well, all financial institutions are racing to court Gen Z.

With over $860 billion in US disposable income (and a habit of saving a third of it), they’re the golden goose that financial app makers are chasing. More than half (56%) of US-based Gen Z’ers (aged 18-25) already own at least some investments. The majority (65%) use financial apps to manage their money and make trades.

They are ditching legacy banks and demanding apps that mirror their values: hyper-personalized, socially-conscious, and packed with TikTok-ified financial education. The future consumers of the financial world crave control, value, and a slick experience. They are compelling devs to ditch the cookie-cutter crap and deliver apps that hit hard and feel personal.

Is your financial institution ready to give them what they want? This blog post is going to be your ultimate guide to financial, i.e., fintech mobile app development in this new era.

Ready to code the future of finance? Let us roll.

What is Financial App Development?

Financial app development is the gritty, creative grind of building digital tools that turn money management from a chore into a power move. It is about crafting mobile or web apps that handle banking, payments, investing, budgeting – you name it – with a focus on security, speed, and convenience.

We are talking apps that let users trade stocks, dodge fees, or build portfolios with every swipe.

Their scope? Everything from AI-driven robo-advisors to blockchain-powered payment rails. Developers today wield tools like machine learning for fraud detection, cloud-native infrastructure for scale, and gamification to turn budgeting into a dopamine hit.

The goal: turn complex financial sludge into seamless, addictive experiences.

It does not matter how your financial app achieves this goal. You can opt for a plug-and-play template app (like many startups do) or custom-build your own masterpiece. Either way, your app must solve a visceral, financial pain point for users.

Types of Financial / Fintech Apps

Financial apps are not a monolith – they are a lineup of heavy-hitters, each swinging for a different goal. Depending on what your fintech mobile app development goals are, here are the different types of financial apps you can consider.

Payment Gateways

These are the backbone of online shopping, processing card payments securely for e-commerce sites. They ensure transactions flow smoothly from buyer to seller.

Examples: PayPal, Stripe, Square

Budgeting Apps

These help individuals track income, expenses, and savings, often with AI-driven insights to keep finances in check.

Financial Forecasting Apps

Used mainly by banks and firms, these predict market trends and assess risks using AI, aiding in investment and loan decisions.

Examples: Bloomberg Terminal, Morningstar

Bookkeeping Software

Essential for businesses, these apps manage accounting tasks like tracking sales and preparing reports, ensuring financial accuracy.

Examples: QuickBooks, Xero, FreshBooks

Online Banking Apps

Provided by traditional banks, these let users manage accounts, transfer money, and pay bills from their phones, offering convenience.

Examples: Bank of America Mobile Banking, Wells Fargo Mobile, Citibank Mobile App

Tax Management Software

These simplify tax filing, track expenses, and estimate liabilities, often with AI to suggest deductions.

Examples: TurboTax, H&R Block, TaxSlayer

P2P Lending and Investment Software

These platforms connect borrowers and lenders directly, offering better rates and flexibility, though they face regulatory scrutiny.

Examples: Lending-Club, Prosper, Upstart

Digital Banking Apps

Fully digital, these neo-banks offer modern, fee-free banking with innovative features, appealing to tech-savvy and socially-conscious users.

Examples: Revolut, Chime, N26, Bunq (plants trees per transaction)

Investment Apps

These enable buying and selling stocks, bonds, and more, often commission-free, with options for green investments.

Examples: Robinhood, Webull, SoFi Invest, Trine (supports sustainable projects)

Budgeting and Expense Tracking Apps

These apps help monitor spending and plan finances, providing a clear picture of money flow.

Examples: Pocket-Guard, Goodbudget, Mint

Payment Apps

For quick transactions, these include mobile wallets and P2P services, with BNPL options for installment payments.

Examples: Venmo, Cash App, Zelle, Afterpay, Klarna

Cryptocurrency Apps

These manage digital currencies, allowing buying, selling, and trading, catering to the crypto-curious.

Examples: Coinbase, Binance, Uniswap

Features That Make a Financial App Stand Out

While there are many types of heavy-hitters in the financial app game – the ‘GOATs’ always have these features in common.

Intuitive UI/UX

In 2025, with users having access to hundreds of apps, a clunky design is a quick way to get uninstalled. Your app should feel like second nature, with a design that is easy to navigate and visually appealing. Check out Monzo‘s vibrant UI or Revolut‘s sleek look.

Biometric Authentication

Security is paramount in fintech apps, and with increasing cyberthreats, users demand the best. Biometric authentication, like fingerprint or face ID, provides a higher level of security and convenience. Make sure your app offers this key feature like Chime and SoFi do.

Seamless Onboarding

First impressions matter – even for calculated financial app users. A smooth sign-up process, like Chime or Betterment, can boost your app’s retention rate by up to 50%.

Multi-Layered Security

85% of digital banking users want providers to prioritize proactive security. Protect your users’ info by adding encryption, multi-factor authentication, and real-time fraud detection to your app. Capital One and Fidelity Investments lead in this department.

Real-time Alerts

Keep users informed with instant notifications about transactions or account changes. Build trust and retain engagement by doing so. Mint and Chase Bank do this quite well.

Language Options

Cater to a global audience by supporting multiple languages.

Live Chat & Chatbots

Offer 24/7 support, whether through humans in live chat like SoFi does or with AI tools like Bank of America’s Erica.

Account Management

Let users manage all their finances in one place like Mint and Quicken do.

Cross-platform Sync

Ensure the app works seamlessly across devices.

Data Visualization

Make data easy to understand with graphs and charts. For inspiration, check out how Personal Capital and Betterment make numbers dance to help their users grasp complex finances. Also, give them customizable dashboards like SoFi and Chime do.

Scanners & QR Codes

Make transactions fast and error-free by letting users scan QR codes to make quick payments within the app. Venmo and Cash App are pioneers of this feature.

Multiple Payment Gateways

Support various payment methods, like Stripe and PayPal. Also include crypto and BNPL to stay relevant with Gen Z.

Digital Wallets

Store payment info securely for users. Let them create their own, custom wallets in your app like Apple Wallet, Google Pay, and PayPal do.

Gamification

Make finance fun with rewards and challenges at each step. Acorns, Robinhood, and Long Game Rewards are great at gamifying in-app features to keep users engaged.

Artificial Intelligence

Use AI for personalized advice and fraud detection, as seen in Betterment and SoFi. Use your custom AI tool to offer users personalized tips like suggesting investments based on spending.

Analytics & Reporting

Provide users deep insights into their spending habits and investments. Make this feature an intrinsic part of your app but let users turn it off if they want.

Offline Access

Ensure all essential app features (budgeting, account management, educational resources, etc.) work without the Internet.

Personal Finance Management Tools

Offer custom budgeting and goal setting tools.

Social Sharing & Referrals

Let users spread the word about your app with an in-built social media sharing option. You can even reward users for sharing like Acorns and Robinhood do.

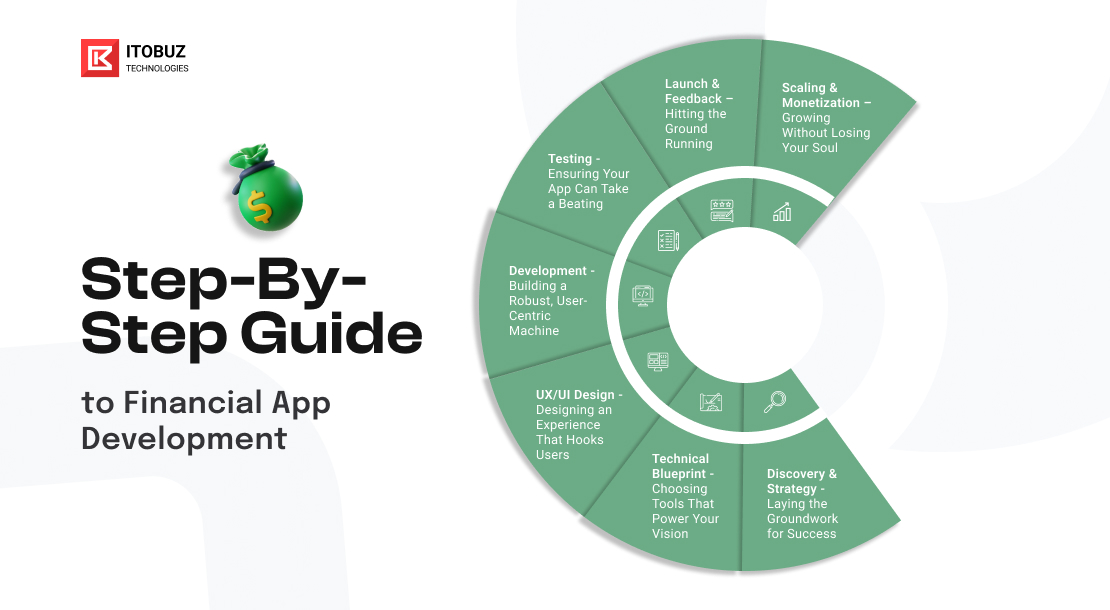

Step-by-Step Guide to Financial App Development

Now that we know what features a top-class financial app ought to have, let us learn how to make one. Fintech app development is a carefully orchestrated journey that demands strategy, creativity, and a relentless focus on users. Here are the key phases of this process.

Phase 1: Discovery & Strategy – Laying the Groundwork for Success

Before you even think about coding, you need to carve out your place in the crowded fintech world. The market in 2025 is teeming with apps, but there are still untapped opportunities-especially ones that speak directly to Gen Z’s unique needs and quirks.

Maybe it is a savings app that gamifies financial literacy with meme-based rewards, or a platform that ties ESG (Environmental, Social, Governance) investing to their passion for sustainability. The key here is to avoid generic ideas; specificity is your weapon.

Start by researching your audience with a detective’s curiosity.

Gen Z is not a uniform group. Some are crypto enthusiasts dreaming of Lambos, while others are gig workers scraping by. Dive into their digital haunts: scroll through Reddit, decode TikTok finance trends, or even chat with them directly.

What frustrates them about existing apps? What would make them download yours? Their answers will shape your app’s purpose and personality. Then, assess the risks.

Fintech is not just about innovation; it is also about navigating a maze of regulations like GDPR or PSD2, ensuring ironclad security, and overcoming adoption hurdles. Map these challenges early so they do not derail you later. This phase is about building a foundation that is as strategic as it is creative. Think of it as plotting your opening move in a high-stakes game.

Phase 2: Technical Blueprint – Choosing Tools That Power Your Vision

Once you have got your strategy locked in, it is time to pick the technological tools that will bring your app to life. Study multiple frameworks for mobile app development. For mobile development, consider React Native – it lets you write code once and deploy it across iOS and Android, saving time while delivering a smooth, native-like experience. Read about the cost to create React Native app before taking this step. On the web, pair React.js for a dynamic frontend with Node.js for a lightweight backend. Together, they offer flexibility and a huge community of support. And if desktop access matters (say, for power users or legacy integration), Electron.js can extend your app to Mac, Windows, and Linux with ease.

At this stage, you are also designing your Minimum Viable Product, or MVP. The goal is to focus on one killer feature (maybe it is AI-powered spending insights or a slick Buy Now, Pay Later integration) and strip away anything that does not serve that core value. This lean approach gets you to market faster, letting you test assumptions and gather feedback without overextending your resources. Security is another cornerstone here. In fintech, a single vulnerability can sink you. Build in biometric logins (like fingerprint or face ID), encrypt data end-to-end, and layer on AI to detect fraud in real time.

Phase 3: UX/UI Design – Designing an Experience That Hooks Users

Your app’s design is not just about looking good. It is about feeling right to the user. Begin with wireframes, which are like rough sketches of each screen. Map out the user journey, i.e., how users move from logging in to checking their budget, before you invest in visuals. Test these early with real people to catch clunky flows.

For younger financial app users, design is personal.

They gravitate toward apps that mirror their digital world. Think bold colors like TikTok, edgy typography, and playful micro-interactions (a cheeky animation when they hit a savings goal). But it is not all flair: accessibility matters too. Add dark mode for late-night scrolling, voice commands for hands-free use, and readable fonts for inclusivity.

Phase 4: Development – Building a Robust, User-Centric Machine

Now it is time to roll up your sleeves and build. For the backend, go cloud-native with platforms like AWS or Azure. These offer scalable infrastructure that grows as your user base does, a crucial factor when your app goes viral.

Plug in third-party integrations to boost functionality. Payment gateways like Stripe, Cash App Pay for seamless transactions and crypto APIs for blockchain features. These shortcuts will save you from reinventing the wheel while enriching the user experience.

The interface should adapt to its audience. Admins might need detailed dashboards to monitor activity, while users want a clean, uncluttered layout that makes finance feel approachable.

Throughout development, agility is key. Use a modular setup, like microservices, so you can tweak one part (say, a new payment feature) without breaking everything else. In fintech, where regulations and trends shift fast, this form of flexibility is a lifesaver.

Phase 5: Testing – Ensuring Your App Can Take a Beating

Testing is not a formality. It is your chance to bulletproof your app. Release a beta version to a small crew of young testers (sweeten the deal with free crypto perks). Their unfiltered feedback will expose flaws you did not see, glitchy buttons, confusing menus, or security holes. Use AI tools to automate tedious tests, but don’t skip the human touch: real users catch what machines miss. Push your app to its limits.

Does it work offline? On a cheap phone with shaky Wi-Fi? In a crowded coffee shop?

Edge cases like these separate the pros from the amateurs. By the end of this phase, your app should be rock-solid-ready to shine under any condition.

Phase 6: Launch & Feedback – Hitting the Ground Running

Launching your app is not the end. It is the beginning.

Make a splash on the App Store and Google Play with a listing that hooks Gen Z: punchy descriptions, screenshots that pop, and keywords like “crypto-ready” or “sustainability-first.” But the real magic happens after launch. Embed surveys or a feedback button right in the app. Gen Z loves to share opinions, and they will tell you exactly what is working (or not).

Track everything: crash reports, how long users stick around, what features they ignore. Run A/B tests to refine new ideas, like tweaking a button color to boost clicks.

This phase is all about listening and adapting.

Phase 7: Scaling & Monetization – Growing Without Losing Your Soul

When your app takes off, scaling is the next frontier.

Add features that tap into 2025’s hot trends. Think AI financial coaching or NFT-based rewards, but keep them tied to real user needs, not hype. Going overboard risks bloating your app and alienating your base.

The next step – monetization requires finesse.

Subscriptions (say, a premium tier with advanced insights) or small transaction fees can work wonders; banner ads, not so much as younger users hate distractions. As you grow, think globally. Tweak your app for new markets with local languages and partnerships to handle regional rules. Scaling is not just about numbers. It is about building an ecosystem that lasts.

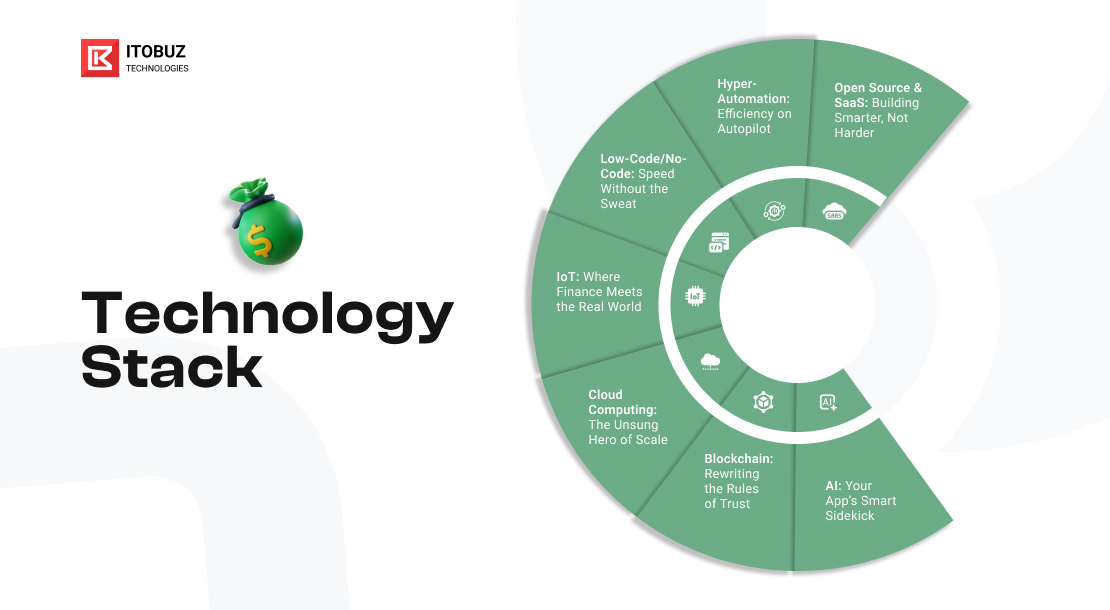

Technologies Transforming Financial App Development

The process above gives you the how, but the tools below are the what-the cutting-edge technologies that will elevate your app from good to game-changing. Let’s dive into each one, exploring how they tie into your development journey and why they matter in 2025.

AI: Your App’s Smart Sidekick

Artificial Intelligence is everywhere in fintech and all mobile app development trends in general, and for very good reasons.

In Fintech, it powers personalization by crunching user data like spending habits and savings goals to offer advice that feels bespoke. Picture this: your MVP from Phase 2 suggests a budget tweak based on a user’s late-night Uber Eats splurge. That is AI at work. It can also bolster security, spotting sketchy transactions faster than a human ever could. And beyond that, AI levels the playing field – using alternative data like social media activity to assess creditworthiness, opening doors for users’ banks often overlook.

Blockchain: Rewriting the Rules of Trust

Blockchain is fintech’s rebel child. Its decentralized nature lets your app bypass traditional gatekeepers, enabling things like peer-to-peer lending or staking through DeFi platforms. Smart contracts, self-executing agreements coded on the blockchain, cut costs and delays, perfect for Phase 4 integrations. Plus, tokenization lets users invest in fractions of assets (think a slice of a sustainable farm). It is a trust revolution that hands power back to users, and your app can lead the charge.

Cloud Computing: The Unsung Hero of Scale

Cloud tech might not grab headlines, but it is a powerhouse.

Its microservices model allows you to update one feature, like a new payment option from Phase 7, without touching the rest, keeping your app nimble.

Serverless setups scale on demand, so you are not overpaying during quiet times or crashing during a rush. It is the quiet backbone that lets you focus on users, not servers.

IoT: Where Finance Meets the Real World

The Internet of Things connects physical devices to your app, unlocking fresh data streams. Imagine a small business using IoT-tracked inventory as collateral for a loan, or insurers pricing their premiums based on users’ fitness tracker. It is real-time insight that makes your app sharper and more relevant, a perfect fit for enhancing Phase 4’s functionality.

Low-Code/No-Code: Speed Without the Sweat

Platforms like Unqork turn app-building into a drag-and-drop breeze. In Phase 2, this means your MVP can launch in weeks, not months, ideal for testing ideas fast. Even non-coders can jump in, prototyping features without draining your budget. It is fintech’s fast lane to innovation.

Hyper-Automation: Efficiency on Autopilot

Hyper-automation blends AI and robotic process automation (RPA) to handle repetitive tasks, like verifying IDs or processing payments. In Phase 4, this cuts manual work, letting your team focus on creativity.

Open Source & SaaS: Building Smarter, Not Harder

Open-source code from GitHub gives you free, tested solutions for tricky fintech needs, such as encryption or analytics. SaaS APIs, meanwhile, handle compliance chores like KYC or fraud checks out of the box. Together, they speed up Phase 2/4, letting you pour energy into what makes your app unique.

Security in Financial App Development: A Non-Negotiable

With 60% of cyberattacks targeting mobile banking apps and cybercrime projected to cost $10.5 trillion in 2025, if your app’s security is not Fort Knox meets Mission Impossible, you are already compromised.

One phishing link can drain millions, torch trust, and invite lawsuits from regulators like the Federal Trade Commission (FTC).

A single vulnerability – say, unencrypted data or a lax login- can unravel everything. Breaches in financial apps do not just bleed cash; they shred reputations and trigger penalties under laws like GDPR or CCPA.

Your app can either be a fortress or a ghost town – your choice.

The Stakes

In 2025, users and regulators demand ironclad protection – anything less, and your app is out of the game.

Key Threats in 2025

The enemy is evolving, and they are armed with tech straight out of an espionage thriller:

- Phishing 2.0: AI-crafted emails impersonate your CFO or hijack threads—90% of breaches start here.

- Ransomware-as-a-Service: Hackers auction your data like NFTs on dark web marketplaces. Pay up? Costs double with recovery.

- Fake Apps: Clones with blurry logos and sneaky permissions steal credentials before users’ blink.

These are not hypotheticals, they are daily realities, amplifying the risks we flagged in the technical blueprint phase.

The Armor

Lock it down with a multi-layered defense.

- Encryption Everywhere: Secure data in transit and at rest with tools like OpenSSL – no exceptions.

- Biometric Lockdown: Ditch passwords for fingerprints or face scans, aligned with FIDO Alliance standards.

- Zero-Trust Architecture: Every login is a suspect—verify relentlessly, per NIST guidelines.

- AI-Powered Vigilance: Machine learning spots fraud, like a login from halfway across the globe, in real-time.

User Education = First Defense

Your users are your weakest link. Gen Z might trust a TikTok “crypto hack,” but they’ll fall for a phishing scam promising free Bitcoin. Arm them with educational content on your app like:

- Spot Fake Apps: Check developer names, ratings, and permissions.

- Avoid Public Wi-Fi: Café hotspots are hacker bait – use VPNs instead.

- Enable Instant Alerts: Real-time notifications catch fraud fast.

Developer Mandates

Security starts in the code.

- Continuous Pen Testing: Simulate attacks with OWASP ZAP—fix flaws before hackers find them.

- Patch Now, Not Later: Automate updates via Jenkins—delays are breach invitations.

- Secure-by-Design Code: Use SonarQube to catch vulnerabilities early – no shortcuts.

In addition to security, compliance will also be non-negotiable for financial apps this year. Expect new mandates like Software Bill of Materials (SBOMs) from agencies like CISA.

The Cost of Financial App Development in 2025

This year, fintech mobile app development costs range from $35k to $500k or more. This figure is driven by your vision, tech choices, and how well you dodge hidden traps.

The Price Tag Spectrum

Here’s the breakdown:

- Basic Apps ($35k–$80k): Think lean budgeting tools like Mint – expense tracking, no frills.

- Mid-Tier ($80k–$200k): Add BNPL, AI insights, or crypto wallets – more muscle, more spend.

- Enterprise Beasts ($200k–$500k+): Robinhood-scale apps with AI, blockchain, and global reach with AWS-grade firepower.

These tiers echo the complexity we mapped in planning – basic apps launch fast; enterprise giants demand time and scale.

Cost Drivers

Your final bill will hinge on factors like:

Tech Stack

- AI/ML: $10k-$50k for fraud detection or robo-advisors

- Blockchain: $30k-$100k+ for DeFi or smart contracts

- Compliance: $10k-$50k to meet PCI DSS or GDPR

- Post-Launch Maintenance: 15-20% of initial spend yearly – updates, patches, survival

Team Geography

- North America: $100-$200/hour – premium quality, steep price

- Asia: $20-$50/hour- cost-effective, but your team will have to sync with those time zones

Want to be cautious spenders. Launch lean with a Minimum Viable Product with core features like AI budgeting or payments via Stripe. Then scale only after you receive positive feedback.

Why? 80% of apps flop in general. Do not bet $500k on a hunch.

Pro Tips

- Use APIs like Plaid for bank links or Twilio for alerts – build less, integrate more, save more.

- Outsource Wisely – hire fintech vets fluent in compliance.

Every dollar ties back to value – security that protects, features that delight. Learn about banking app development costs to find out how. Understanding the investment needed for your banking app ensures you get the best balance of innovation, functionality, and user satisfaction.

But value is not just in what users see; it is in how they feel using it. That is where design comes in, turning raw functionality into an experience worth sticking around for.

Best Practices for UI/UX Design in Financial Apps

In fintech, design is not just about looking good – it is about feeling right. 73% of users would switch digital banks if one app makes them feel better than the other. UI/UX is where your app becomes more than code – it becomes a tool that users rely on and enjoy.

Core UI/UX Principles That Matter

As always – security and trust lead the pack. Users need to know their money is safe without feeling bogged down. Biometric logins, like fingerprints or face scans, blend security with ease, while clear privacy info reassures them.

Simplicity is next. Break complex tasks, like transferring funds, into clear steps with plain language. No one wants to wrestle with jargon mid-transaction.

Then, personalization makes it all feel personal. Use data to nudge users with tips like “You are close to your savings goal—keep it up!” But do not overstep – let them tweak dashboards or alerts to fit their style.

Lastly, accessibility seals the deal – design for everyone. Screen readers, scalable text, and high-contrast colors are not extras; they are essentials, echoing the inclusivity we have built into every phase.

Designing It Right

Start with user research. Interviews and tests reveal what clicks and what clunks, just like the feedback loops in our development process. A consistent design language (uniform colors, fonts, icons) ties it all together, making your app feel like home across devices.

Your users will make errors. Your app must handle them gracefully. A failed payment should not just say “Error 404”. It should say, “Card declined – check your details or try again.” Validate inputs live to catch mistakes early.

And performance? It is non-negotiable. Slow loads or choppy animations frustrate users. Optimize data, cache smartly, and keep transitions smooth.

UX Engagement

Also, make all finance-related interactions in your app approachable. Spending analytics or savings jars turn numbers into stories users care about. Use gamification (points for saving, badges for goals) to add a spark and make the routine feel rewarding.

But keep it clear. Users should always know what’s happening and how to act.

Accessibility: Designing for Everyone

Use voice navigation to break down barriers for motor-impaired users. Let them control the app hands-free. Similarly, use dyslexia-friendly fonts, like the ones offered by Open-Dyslexic. These fonts reduce visual confusion and make text readable for users with dyslexia.

More Security: Protection Without the Pain

Let us say it for the hundredth time – security is non-negotiable in fintech. But, measures like two-factor authentication (2FA) and Know Your Customer (KYC) checks can slow users down and spark frustration.

The challenge? Keeping users safe without making them feel punished.

One fix is microcopy magic- short, friendly messages that add a dash of personality to security-related messages. Pair that with digestible and visual in-app educational content, such as quick tips on spotting scams or avoiding phishing attempts. It empowers users without preaching.

Fintech’s next frontier is all about smarter, more immersive experiences. Use these strategies to create fintech UX that feels personal, engaging, and downright exciting.

Case Studies: Financial Apps Leading the Market

Before we let you go, let us dive into three heavyweights in this field – Mint, Robinhood, and PayPal – that have cracked the code on design, functionality, and growth. Their stories echo the security, cost, and UX principles we have explored so far.

Mint: Mastering the Everyday Money Game

Imagine a world where budgeting does not feel like torture. That is Mint’s magic. Launched in 2007 by Aaron Patzer, Mint hit 1.5 million users in two years and snagged a $170 million buyout from Intuit.

How?

It was a one-stop shop for personal finance – linking accounts, tracking budgets, and nudging users toward smarter habits. Mint’s toolbox is packed: budget tracking categorizes spending (groceries, Netflix binges), bill reminders dodge late fees, and credit score monitoring keeps users in the know – all secured with bank-level encryption and optional two-factor authentication (2FA).

The design? Clean, intuitive, no PhD required – proof that simplicity trumps complexity.

Lesson: Know your user inside out. Mint’s growth hacked its way to millions by targeting young professionals and finance nerds, hyping a product that did not exist yet with blogs and niche influencers. Build for the everyday, secure it tight, and make it effortless.

Robinhood: Rewriting Investing for the Bold

Robinhood flipped Wall Street on its head – commission-free trading for stocks, ETFs, options, and crypto, all wrapped in an app that screams “you don’t need a suit to play.” Founded by Vladimir Tenev and Baiju Bhatt, it hit 15.9 million active users by 2021, raking in $1.81 billion in revenue—a 90% jump year-over-year.

The secret? Gamifying the waitlist pre-launch, netting 700k sign-ups before day one.

The app’s edge is its easy-to-use interface. Buying Tesla shares feels as simple as ordering pizza, paired with fractional shares, letting anyone with $10 join the game. Robinhood Gold adds premium perks like extended trading hours, while crypto trading taps into 2025’s digital gold rush.

Security? Industry-standard encryption keeps it legit.

But the real kicker is its UX – smooth, mobile-first, with news and research baked in.

Lesson: Democratize access and gamify engagement. Robinhood’s referral-driven waitlist turned hype into users – over 50% of sign-ups came from friends inviting friends. Strip away barriers, but don’t skimp on security or design polish.

PayPal: The Payment King Still Reigns

PayPal’s been at it since 1998, and by 2022, it dominated with 429 million active accounts, processing $2.5 billion daily. It is the master of online payments—send cash to a pal, pay bills, or shop globally, all with buyer and seller protection to fend off fraud.

Features like QR code payments and instant transfers keep it modern, while international payments span 200+ countries.

What is its growth hack? Paid referrals – $10 for you, $10 for them – sparked a 7-10% daily user spike, hitting 100 million at $20 per signup. Today, it is $10 each after a $5 spend, capped at $100 per user. Design-wise, it is straightforward – functional over fancy, but secure, with VeriSign-level encryption.

Lesson: Incentivize sharing and prioritize trust. PayPal’s referral engine turned users into evangelists, proving a strong core (payments) plus security beats complexity every time.

How to Market Your Financial App for Maximum Reach

You have built a killer app – secure as Fort Knox, cost-smart, and packed with UX gold.

Now, how do you get it into millions of hands?

Marketing is not just ads. It is strategy, psychology, and a dash of hustle. Let us pull lessons from Mint, Robinhood, PayPal, and other successful financial apps to craft a playbook for 2025.

Know Your Crowd, Then Wow Them

Mint did not guess. They stalked coffee shops to nail their audience- young pros craving control. Start there – survey, chat, stalk TikTok if you must.

Who is your user? Crypto-curious Gen Z? ESG-driven millennials?

Once you have got them pegged, tailor everything – features, tone, channels. Mint’s niche blog sponsorships hit undervalued spots. Find yours, be it in Reddit threads or finance Discord servers, and personalize the pitch.

Hype It Before It Exists

Robinhood and Mint mastered pre-launch buzz. Robinhood gamified its waitlist – refer friends, jump the line – turning hype into 700k sign-ups.

Mint collected emails with finance tip newsletters, hitting 100k pre-launch.

Blueleaf took it further with intrigue and exclusivity – public sign-up requests on social media, limited invite windows sparking urgency.

Build anticipation. Tease features on X, drop a landing page, and collect emails like they are gold.

Turn Users into Evangelists

PayPal’s $10 referral trick grew them to 100 million. Users spread the word because it paid. Robinhood’s waitlist did the same – 50% of sign-ups from referrals.

Blueleaf’s twist? Limit referral windows to an hour, driving a frenzy.

Incentivize sharing, cash, perks, bragging rights, etc., and make it dead simple with call-to-action buttons. Use social proof (showing waitlist numbers) to seal the deal.

Balance Exclusivity and Access

Blueleaf’s strict invite system, public begs or user referrals, created a velvet-rope vibe, echoing Robinhood’s queue-jumping allure. Limit early access to build demand, but do not lock out too long. Balance scarcity with scale.

Post-launch, lean on Google Play and App Store optimization. Keywords like “secure finance” or “crypto easy” to widen your net.

Educate and Engage

Mint’s content marketing, blogs, tips, taught users while hyping the app. Tie this to UX education (scam alerts, microcopy) to turn your app into a trusted guide.

In 2025, short-form video (TikTok, Reels) or AR demos could drastically amplify reach.

Marketing is your megaphone – use it to amplify what’s great, not mask what’s weak.

Pro Tip: Forget billboards. 50% of Gen Z discovers apps via Instagram Reels. Be where the scroll is.

Conclusion

Financial app development is reshaping how we live money. The opportunities? Limitless. Whether it is gamifying savings, slashing fees, or securing trust, innovative mobile app solutions are your ticket to stand out. Mint taught us to simplify, Robinhood to democratize, PayPal to incentivize. These are not just apps. They are movements, and you could start the next one. The tech’s here—AI, blockchain, AR – the users are waiting, and the market’s ripe. Ready to jump in? Don’t wing it alone.

Partner with pros who live and breathe this stuff. Itobuz offers world-class FinTech app development services with free consultations and tailored quotes. Hit us up – tell us your vision, and let us launch a code-fueled heist. The future of finance is calling – build it big, build it smart, and build it now – or watch someone else clone your idea and cash in.

comments

comments for this post are closed